Table of Contents

Difference between renting and leasing

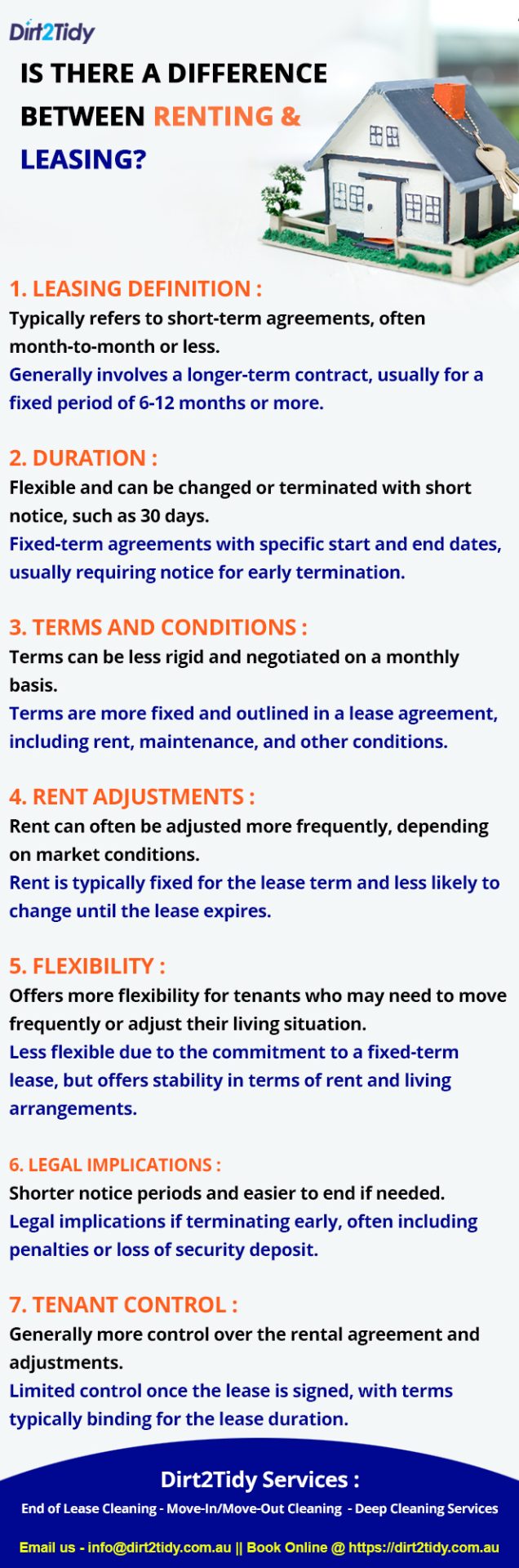

On the lookout for a new place to call home, but can’t decide between renting and leasing? Many people are surprised to learn that there is a difference between renting and leasing, each with its own pros and cons during a rental period, whether it’s a short term or month to month rental agreement.

A generation ago, renting was seen as a temporary setback on the path to homeownership; today, more than a third of all Australian households are renters and not property owners. Leasing and renting are both accomplished through contracts, but they serve distinct functions when renting a house.

When comparing leasing and renting, what are the key distinctions?

difference between renting and leasing

Signing a lease agreement is a standard practice for landlords prior to tenants moving into a rental property. A lease is a legally binding agreement between two parties whereby one party agrees to let the other party use an asset such as a home or apartment for a predetermined period of time and under specified terms and conditions.

In exchange for consistent payments, the parties agree to enter into this lease contract for a period of six or twelve months.While renting also involves a tenant making regular monetary payments to a landlord in exchange for housing, leasing encompasses more defined terms within its agreement.

A lease agreement outlines the terms of the contract clearly, specifying the duration—typically one year or longer—and what occurs after the term ends, such as the option for month-to-month tenancy. This structured timeline provides both parties with a clear understanding of their commitments.

To prevent disputes, a lease agreement generally details the expectations of both the lessor and lessee. This includes rent and deposit amounts, usage restrictions like a pet policy, and whether amenities such as a parking space are included. These specifics ensure clarity and minimize potential conflicts.

Rent, in essence, is a straightforward transaction for the right to live in a property, but there’s more beneath the surface that defines this common practice. Leasing may not be for everyone, but it offers a secure, predictable framework that can be appealing to many renters.

.At its core, renting is a contract between a landlord and a tenant. This agreement can be either formal, with documents involved, or as simple as a spoken promise. Typically, these arrangements are short-term or month-to-month, offering the flexibility to renew or adjust terms frequently.

Within this agreement, tenants agree to make regular payments to live on the premises. The rental contract often outlines critical details such as:

- Terms of Tenancy: How long the renter is allowed to stay.

- Rent and Security Deposit: The amount paid monthly and initially to secure the rental.

- Included Amenities: What utilities or services are part of the rent.

- Pet Policies: Rules regarding pets on the property.

Most rental agreements naturally renew unless a tenant provides written notice, usually 30 days in advance. This month-to-month structure can be particularly appealing for those seeking a degree of flexibility in their living arrangements. Renting, therefore, isn’t just a financial transaction; it’s a dynamic framework that provides both stability and adaptability in housing.”

Understanding Rental Agreements

A rental agreement is not just a mere handshake. It’s a legal document that outlines the terms and conditions binding both tenant and landlord. Here’s what it typically includes:

- Names and Addresses: Clarity on who is involved and how to reach them.

- Property Description: Details about what exactly is being rented.

- Rental Period: The start and end dates that frame the agreement’s timeline.

- Rent Amount and Payment Schedule: The financial backbone of the agreement, specifying how much is due and when.

- Security Deposit: The upfront payment and the conditions for its return.

- Maintenance and Repairs: Who’s responsible for what when something breaks.

- Rules and Regulations: The do’s and don’ts while occupying the property.

Types of Rentals

The rental landscape is diverse. Here are a few common types:

- Single-room Rental: Perfect for those who need just a room in a shared space.

- Short-term Rental: Ideal for vacations or temporary stays, often just a few days or weeks.

- Furnished Rental: Move-in ready with all the essentials, from furniture to appliances.

Pros and Cons of Renting

Renting offers a mixed bag of benefits and drawbacks:

- Pros:

- Flexibility: Easily move out at the end of the rental period. which is ideal for those seeking to avoid long-term commitments or who might relocate for work or personal reasons.

- Maintenance: Typically the landlord’s responsibility for maintenance issues, saving renters the hassle and expense of repairs and upkeep.

- Cost: Often more affordable than leasing in certain areasespecially where housing prices are high, making it a practical choice for those not ready to purchase a home.

In addition to these advantages, renting can offer further benefits:

- Cost-effectiveness: Signing a longer lease can reduce costs for landlords, who may then pass on savings in the form of lower rent. This is particularly appealing for renters willing to commit to longer tenancy periods.

- Greater availability: Longer-term rental agreements might be more readily available due to lower turnover, offering a broader range of options to choose from.

- Fixed monthly payment: With a lease of a year or more, renters can enjoy the stability of a consistent monthly payment, avoiding unexpected rent hikes that are common with short-term arrangements.

While renting can provide these advantages, it’s important to weigh them against any potential drawbacks to make the choice that best suits your lifestyle and financial situation.

- Cons:

- Stability: Less long-term security compared to owning.

- Rent Increases: Potential for higher costs at the end of each period.

- Renewal Uncertainty: No guaranteed option to renew the agreement.

Renting is a versatile option that caters to a variety of needs, offering both convenience and challenges along the way.”

Leasing is more commonly used than renting when referring to commercial real estate for reasons other than the duration of the lease agreement. However, the word “rent” can still be used to describe a recurring fee.

Exactly how do leases for real estate properties function?

difference between renting and leasing

Leases for specific durations are the norm in the Australian real estate market. Commercial leases typically run for six or twelve months, though other terms may be possible depending on the landlord’s availability.

Renewal Options and Transitioning Leases

Lease agreements offer a notable advantage in terms of renewal options. At the end of a lease term, tenants usually have the opportunity to renew the lease, providing a sense of long-term housing stability. In contrast, rental agreements generally do not offer such renewal options, which can result in more frequent moves or adjustments for tenants.

The lease on some properties is periodic, meaning that either party can terminate it at any time by giving the other the necessary notice. If the landlord and tenant do not sign a new lease before the end of the fixed-term lease, the property may revert to a month-to-month lease.

Renewal Options for Leases and Rentals

When it comes to renewing leases, tenants and landlords have several options to consider. Renewals can offer tenants the comfort of stability, sparing them the upheaval of moving, while providing landlords the advantage of retaining a dependable tenant without the costs associated with acquiring a new one.

Renewal terms often include:

- Adjustments to Rent: It’s common for landlords to revise the rent amount to reflect market changes or property improvements.

- Lease Duration Changes: The renewal can extend the lease for another fixed term or continue on a month-to-month basis.

- Updated Policies: Both parties should carefully review any alterations to the lease agreement, ensuring they align with their expectations and legal obligations.

Understanding relevant local rental laws is crucial for both parties. This ensures the renewal process is equitable and protects the interests of tenants and landlords alike. By being well-informed and proactive, both parties can enjoy continued harmony in their rental arrangements.

This transition allows for flexibility, although it does not provide the same stability as a renewed fixed-term lease.

By understanding these options, tenants can make informed decisions about their housing choices, balancing the need for stability with the desire for flexibility.

A security deposit or bond is usually required at the beginning of a lease when renting from the landlord. This is a safety net for the landlord in case the tenant doesn’t pay rent usually four to six weeks’ worth. If the premises are left in good condition and undamaged when the tenant vacates, the security deposit or bond will be returned to them.

This bond not only covers unpaid rent but also acts as security in case the tenant doesn’t adhere to other terms of the lease—such as leaving the property in poor condition or causing damage. Typically, the bond amount depends on the weekly rent and the policies in your area. If repairs are needed due to damage caused by the tenant or their guests, the landlord may deduct the cost from the bond. However, if everything is in order when the lease ends, the full amount should be returned to the tenant.

It’s important for both landlords and tenants to understand when the bond may be withheld and what conditions must be met for a full refund. This helps ensure a smooth experience at the end of the tenancy and protects the interests of both parties.

Rent is paid in accordance with the terms of the lease, typically on a weekly or biweekly schedule, and handled by the landlord, property manager, or real estate agent. A tenant can be served with a breach notice for nonpayment of rent. In addition, if the problem is not fixed, the tenant may be forced to move out.

Landlords have an obligation to their tenants to maintain the rental property in a habitable condition and to fix any issues that may arise. There is an obligation for tenants to ensure that they are in accordance with the terms of their lease, and tenants are typically expected to pay for repairs that they cause.

When leasing a house, additional considerations come into play that might not be as prominent in other types of leases:

- Yard Maintenance: It’s crucial to establish whether the tenant or landlord is responsible for tasks like mowing the lawn, trimming bushes, or clearing snow. These responsibilities can significantly affect the tenant’s time and budget.

- Parking Arrangements: Clarifying if there are designated parking spots, driveway usage, or garage access helps prevent potential disputes and ensures smooth day-to-day living.

- Local Service Fees: Use the leasing agreement to pinpoint who covers sewage services, trash pickup, and other local fees. This clarity avoids unexpected costs.

- Utility Bills: Some landlords manage utility accounts themselves, while others require tenants to set up and pay for water, electric, and gas bills. Clarifying this in the lease agreement helps avoid confusion.

By addressing these aspects, both landlords and tenants can enter the lease agreement with a clear understanding of their roles and responsibilities, ensuring a smoother leasing experience.

Understanding Rent Increases in Lease and Rental Agreements

When navigating the complexities of renting, understanding how rent increases work in lease and rental agreements can save you from unexpected financial surprises.

Lease Agreements

In a fixed-term lease agreement, the rent is typically locked in for the duration of the term. Landlords cannot increase the rent during this period unless it’s explicitly allowed by a provision within the contract. If a rent increase is part of the initial agreement, it will clearly outline the terms, including when and by how much the rent will increase.

Rental Agreements

On the other hand, rental agreements that are renewed at each rental period, usually on a monthly basis, offer more flexibility for rent adjustments. Landlords can increase the rent at the end of each rental term. However, they must provide proper notice, which varies by location—typically anywhere from 30 to 60 days.

Key Considerations

- Notification: Whether in a lease or rental agreement, landlords are required to notify tenants of any changes to rent. The specific duration of this notice can depend on local laws.

- Legal Compliance: Landlords must also ensure that any rent increases comply with relevant state or local laws. This often includes limits on the percentage increase or caps based on inflation.

- Negotiation: Tenants may have the opportunity to negotiate rent increases, depending on market conditions and the relationship with the landlord.

Understanding these distinctions between lease and rental agreements is crucial for managing your housing budget and ensuring a fair renting experience.

Rent Increase Rules and Notice Periods in Australia

- Queensland: Rent cannot be increased within the first six months of a tenancy or within six months of a previous increase. Tenants must receive at least two months’ written notice.

- NSW & Victoria: Rent can generally increase no more than once every 12 months. Tenants must be given at least 60 days’ written notice before the increase.

These rules help provide tenants with stability and time to adjust budgets. Always check local tenancy guidelines, as rules may change.

The Benefits and Drawbacks of Leasing and Renting

difference between renting and leasing

Housing stability can be achieved over a longer period of time through leasing, which is an advantage. If you, the tenant, have to vacate the premises before the end of the lease term, you are still responsible for paying the rent through the end of the lease term unless a new tenant is found to take over the remaining period.

Assume, for the sake of argument, that you and your live-in partner recently broke up and have decided to part ways, with both of you vacating the shared apartment two months into the lease’s remaining term. In accordance with the lease terms, you must keep up with rent payments for the remaining two months until a new tenant is found to occupy the space.

However, it’s important to note that the possibility of terminating a lease early can greatly depend on the terms outlined in your lease agreement. Some agreements may offer a way out, allowing for early termination under specific conditions, such as:

- Paying a termination fee: Some landlords might require a fee to cover potential losses.

- Finding a replacement tenant: You might be responsible for securing someone to take over your lease.

On the other hand, if you break the lease without meeting these conditions or obtaining permission, you could face legal consequences and financial penalties. This underscores the importance of reviewing your lease agreement thoroughly and discussing your options with your landlord or a legal advisor before making a decision.

A lease doesn’t give you as much leeway as a rental agreement does, and that’s one of its drawbacks. Until the lease has been terminated, the landlord is not allowed to increase the rent or ask the tenant to vacate the premises without consequences.

Renting

difference between renting and leasing

When compared to a lease, a rental agreement allows for more manoeuvrability. If you give us enough notice, we can modify or terminate the lease agreement and allow you to move into the property.

Landlords face more risk when allowing for shorter lease terms because there is no assurance that a tenant will remain in the building for the long term, which can increase vacancy and turnover rates.

Can You Negotiate Rent with a Landlord?

Absolutely, rent negotiation with a landlord is a viable option. While your success largely hinges on the landlord’s flexibility and the dynamics of the local rental market, there are strategic ways to approach the situation.

- Research Comparable Rental Rates: Begin by gathering information on similar properties in the area. Websites like Zillow or Rent.com can be invaluable resources to help you understand the prevailing market rates. Presenting this data can bolster your case.

- Highlight Your Tenant Qualities: Position yourself as an ideal tenant by emphasizing your reliable payment history and reputable references. Landlords value stability and may be more inclined to negotiate with someone who demonstrates such qualities.

- Consider the Timing: Timing is critical in negotiations. Approach the landlord when the rental market is less competitive, such as during the winter months, when there is typically less demand for rentals.

- Propose a Win-Win Scenario: Suggest compromises like a longer lease commitment or offering to handle minor maintenance tasks in exchange for a reduced rate. This can provide value to the landlord while meeting your needs.

- Be Prepared for Flexibility: If the landlord is hesitant to lower the rent, consider negotiating for other benefits. These might include parking spaces, utilities, or an upgraded appliance, which can add value to your living situation without altering the monthly rent.

In summary, successfully negotiating rent requires preparation, market knowledge, and a mindful approach. Be respectful in your proposal and open to a dialogue that seeks mutual benefit.

Should You Rent With or Without a Lease?

When deciding whether to rent with or without a lease, consider the unique benefits and potential pitfalls of each option.

Renting Without a Lease:

Opting for a rental without a formal lease often results in a “tenancy-at-will” arrangement. This option might suit those who value flexibility. Here’s why it might be appealing:

- Flexibility: Move in or out with minimal notice, offering convenience for those facing unpredictable circumstances.

- Simple Terms: Often less complex than a lease agreement, making it easier for quick, temporary arrangements.

However, this approach carries some risks:

- Instability: Without a lease, you might face unexpected changes in rent or conditions, and there’s a possibility of being asked to move out with little notice.

- Limited Protections: Formal protections may be weaker compared to a lease agreement, leaving room for disputes.

Renting With a Lease:

On the flip side, renting with a lease offers numerous advantages:

- Security: A lease agreement offers stability. It locks in terms, rent amounts, and duration, protecting against sudden changes.

- Clear Expectations: Both landlord and tenant agree to specific terms, reducing misunderstandings. It provides a solid reference if conflicts arise.

However, be aware of the fixed nature:

- Less Flexibility: Committing to a specific term can be a drawback if your plans change.

Ultimately, the choice between a lease and no lease comes down to your lifestyle and needs. For those craving stability, a lease is generally the safer bet. Conversely, those with fluid circumstances might prefer the adaptability of renting without a lease. Deciding the best path involves balancing these factors against your personal and financial situation.

Concluding Remarks

difference between renting and leasing

Your individual situation will determine whether you should lease or rent your property. Renting is a great substitute for leasing if your requirements are malleable and you’d rather not make a long-term commitment.

- For Tenants: Renting offers a short-term solution, perfect for those who need flexibility or plan on relocating soon. On the other hand, if you prefer the security of legally binding terms, leasing could be the better option, providing you with long-term stability and peace of mind.

- For Landlords: Leasing can reduce the need for frequent tenant recruiting, offering a reliable income stream and less frequent turnover. However, if you value the freedom to adapt quickly to changing circumstances, a rental agreement allows you to terminate agreements that no longer fit your needs.

Ultimately, the choice between renting and leasing hinges on whether flexibility or security aligns more closely with your current priorities, whether you’re a tenant or a property owner.

On the other hand, if you prefer the security of legally binding terms, leasing could be the better option.

Before you make a decision, it’s crucial to consider a few key factors: real estate

- Legal Implications: Both leasing and renting involve entering into a legally binding contract. Understand the terms and conditions thoroughly to ensure you’re aware of your rights and obligations.

- Consequences of Breaking the Agreement: Be mindful that breaking a lease or rental agreement can lead to penalties or legal repercussions. Always know the potential consequences before signing.

- Rights and Obligations: Familiarize yourself with what is expected of you and what you can expect from the other party. This knowledge will help you avoid any unpleasant surprises down the line.

Consult with one of our knowledgeable real estate attorneys today if you have any remaining questions.