Table of Contents

Mastering the Art of Rent an Apartment While Unemployed

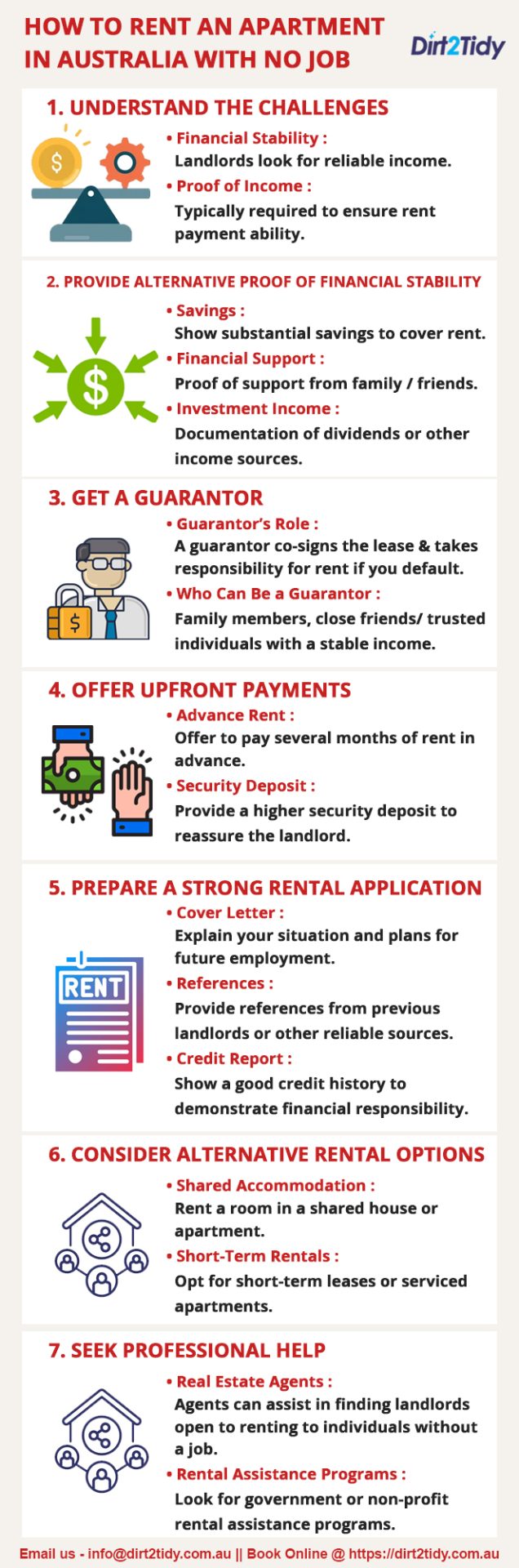

The Rent An Apartment can be a daunting task, especially when you’re facing unemployment. Perhaps you found yourself laid off during the relentless waves of the coronavirus pandemic or decided to relocate before securing a new job. Whatever your situation, the need for a roof over your head remains a top priority.

Fortunately, even without a job or a regular income, you can still secure a rent an apartment home through real estate agents and property managers. However, to increase your chances of approval, it’s crucial to be well-prepared and strategic in your approach.

Navigating the Rental Process with Agents

Renting through a real estate agent in Australia is easier when you’re prepared. Here’s a quick guide:

1. Gather Documents:

Have your ID, recent bank statements, visa (if applicable), proof of income or support, rental references, and tenant ledger ready before you start searching.

2. Search and Inspect:

Browse platforms like realestate.com.au or Domain. At inspections, ask about move-in dates, utilities, parking, and pet policies.

3. Apply Fast:

Submit accurate applications promptly. If unemployed, consider a guarantor—preferably a local resident—to strengthen your case.

4. Review the Lease:

Read the agreement carefully and complete the condition report, noting any existing marks or damages to avoid bond issues later.

5. Pay Bond and Rent:

Lodge your bond (about four weeks’ rent) with your state’s Bond Authority and keep official receipts.

6. Set Up Utilities & Move In:

Arrange electricity, gas, and internet, and furnish your space affordably through second-hand sources.

With the right prep and persistence, you can secure a great rental—even without current employment.

1. Seek Out Private Landlords

Traditional property management companies offer several conveniences, such as standardized rent payment procedures, dedicated maintenance teams, and readily available customer support. While these benefits are undeniably valuable, they tend to have stricter income requirements, making it challenging for the unemployed to secure a lease.

Weighing Your Rental Options

Traditional Property Management:

Offers strong legal protection and peace of mind but comes with stricter income requirements, longer leases, and less flexibility—challenging if you’re between jobs.

Private Landlords:

Often more flexible with approval criteria and lease terms, making them a practical alternative if you need faster approval or a shorter commitment.

To overcome this hurdle, consider broadening your search to include private landlords. Private landlords often have more flexibility in their rental criteria and are open to considering various factors when evaluating potential tenants. This can be especially advantageous for those in transitional phases, such as unemployment, as it increases your chances of finding a sympathetic landlord willing to work with your situation.

By exploring opportunities beyond the confines of traditional property management companies, you’ll discover a wider range of rental options that may be more accommodating to your current circumstances.

Renting from Private Landlords vs. Property Managers

Private Landlords

✅ Pros: Usually cheaper, faster approval, and more flexible—ideal if you’re between jobs or have limited credit history.

❌ Cons: Less structure and protection. Disputes over rent or deposits are more common, so always use formal contracts, receipts, and bank transfers for safety.

Property Management Companies

✅ Pros: Offer professional maintenance, legal protection, and a wide range of properties.

❌ Cons: Stricter requirements, longer leases, and more paperwork—less flexibility if your situation changes.

Private landlords can be more flexible with approval documents when only bank accounts are involved, as in the case of bad credit scores. Traditional management companies require proof of income, but some private landlords only want a credit report and bank statements to secure a rental.

Look for private landlords on Craigslist, Facebook, or apartment-listing websites. You could also drive (or walk) around a neighbourhood you’re interested in; smaller, less tech-savvy landlords may post “For Rent” signs.

What to Check During an Apartment Inspection

Photos can be deceiving—inspect rentals in person before signing. Here’s what to look for:

- Cleanliness & Condition: Check for mould, stains, or pests.

- Maintenance: Test taps, toilets, lights, and appliances for faults.

- Safety: Ensure locks, windows, and smoke alarms work properly.

- Amenities: Verify shared areas like laundry or gyms are in good shape.

- Atmosphere: Observe the neighbourhood and, if possible, chat with residents.

A careful walkthrough helps you spot issues early and ensures your new home meets expectations.

Sublease instead of renting

Sublet if you’re unemployed and apartment hunting with bad rental history. Subletters often have lower income and credit requirements because their rent an apartment is “guaranteed” by the original tenant.

Subletting has other advantages. Because the original tenant subsidizes the rent or because of rent control, sublets are often cheaper than market rates.

Bonus if you live in a city where tenants pay broker fees—you’ll avoid them. You won’t be locked in for a year, which is helpful if you find a new job. The caretaker lists local sublets.

Nontraditional income proof

Even without a full-time job, you may have other sources of income. Did your last job offer severance? That’s income. Unemployment, child support, alimony, and tax refunds are also sources of income. In Australia, it’s illegal for landlords to discriminate based on applicants’ income.

Don’t forget to include any and all nontraditional income streams in your rental application—anything that puts money in your bank account counts. For example, a lump sum from a severance package, regular Centrelink payments, or even a recent tax refund can bolster your case. In some states and territories, landlords are also prohibited from discriminating based on the source of your income, similar to protections in places like New York, Washington, and California.

In your rental application, list all income sources. These extra payments may convince a landlord you can afford the rent. Detailed documentation reassures hesitant landlords you’re able to meet your financial obligations, even if your income isn’t from traditional employment.

Clarify Utility, Gas, and Internet Costs

Before signing your lease, confirm which utilities are included in the rent and which you’ll pay separately. Ask about water, gas, electricity, and internet—some rentals include a few, others none.

If sharing, agree on how bills will be split to avoid disputes. Clear communication upfront helps you budget properly and prevents unexpected costs later.

Prepay more

Assess your finances. You could use your savings or borrow from a friend or family member. If you can pay a few months’ rent or the entire lease upfront, a landlord is more likely to approve your application, assuming you can provide them with proof beforehand that you actually have the money in your account ready to go.

In Sydney, it’s illegal for landlords to require more than the security deposit and first month’s rent when tenants move in. Even if you’re willing to pay more rent upfront, the landlord may refuse.

Understanding the Deposit (Bond)

After signing your lease, you’ll pay a security deposit—usually one month’s rent—known as a bond. It must be lodged with a government-regulated authority, not given directly to the landlord. You’ll receive an official receipt, ensuring your money is protected and refundable when your tenancy ends (if no damages or unpaid rent).

Guarantor

Ask friends and family to co-sign your lease as guarantors. A guarantor “guarantees” your rent, meaning if you can’t pay your landlord, they must.

Unable to find a guarantor? The potential guarantor faces a major financial risk. Landlords expect guarantors to earn 80-100 times the monthly rent per year. Having one usually overrides a landlord’s concerns about your income or employment status.

If you don’t have a guarantor, you can use a guarantor service. In this case, you pay a cosigner fee. These services aren’t as helpful as a traditional guarantor, though. Guarantor services—such as Insurent, The Guarantors, or Rhino—work by acting as a third-party cosigner for a fee. While this option can get your application over the finish line if you have no friends or family able or willing to step in, keep in mind these services may not be as persuasive to landlords as a traditional guarantor with a personal connection. Some landlords may also prefer or require a personal guarantor, so check before paying any fees.

What to Know Before Signing a Rental Contract

Before signing your lease, review every detail carefully. Most agreements start with a six-month term and may switch to a month-to-month arrangement later.

You’ll receive a Condition Report—inspect the property thoroughly and note any marks, stains, or damage before returning it. This protects you from being held responsible for pre-existing issues.

Quick tips:

- Read the entire lease and clarify anything you don’t understand.

- Ensure both parties sign and keep copies of the agreement.

- Document extra terms like pets or garden care.

- Store your lease and report safely for future reference.

Taking a few extra minutes now can save major headaches when it’s time to move out.

References from previous landlords

Use your relationship with past landlords to your advantage. Request a reference letter. This letter should recommend you as a reliable rent payer. Reference it on your new rental application.

If you had a positive rental history, reach out to previous landlords and ask if they’ll vouch for you as a model tenant—ideally, someone who pays rent on time and keeps the place in good shape. A glowing note from a former landlord can make your application stand out, especially if you’re competing with applicants with more traditional income. Including this reference with your application can reassure your future landlord that you’re a trustworthy tenant, even if your employment is nontraditional or your income is variable.

Conclusion: Renting Without a Job Is Possible—with the Right Strategy

Finding an apartment while unemployed may feel daunting, but it’s far from impossible. By staying proactive, organized, and transparent, you can turn potential obstacles into opportunities. From gathering the right documents and securing a guarantor to showcasing nontraditional income and considering private landlords or subleases, preparation is your best advantage.

Remember—landlords and agents value responsibility and honesty just as much as income stability. Prove you’re a reliable tenant through strong references, clear communication, and a well-prepared application.